We are delighted to announce our partnership with humm. Why? Because the Buy Now Pay Later and Consumer Credit market is booming, especially since the COVID-19 pandemic, as it benefits both consumers who get more flexibility with their finances, and merchants who can offer cost-effective options and boost their checkout conversion rate.

Humm Group Limited (ASX: HUM) traces its origins back to 1988 and offers financial services to a network of 16,000 retailers and business partners including multi-billion-dollar giants such as Harvey Norman. Their core product offers customers a flexible way to pay in smaller, more affordable instalments, up to £30K!

Now their brand is bleeding orange as they release their Magento 2 integration, especially to the UK market. To celebrate, we are partnering up so you can leverage both our solutions in just a few clicks to reduce your cart abandonment and get more sales without any additional advertising spend.

Humm UK and Ireland CEO, PJ Byrne said:

‘As we continue to grow our UK presence following FCA approval, we’re thrilled to be partnering with OneStepCheckout to enable Magento merchants to double down on improving their Checkout conversion rates.

We’ve seen a huge increase in demand for split-payment solutions, embedded directly into e-commerce platforms, bringing the benefits of flexible credit directly to customers. This new raft of partnerships is the next step in our ambition to bring the credit market into the 21st Century, offering a range of credit solutions at different stages of customers’ lives.’

Who is humm?

humm is ranking among the top 200 companies on the Australian Securities Exchange and can rely on over 30 years’ experience to meet the needs of both consumers and merchants. The rebrand supports their strategic decision to divest from Commercial Leasing operations and focus as a pure digital credit finance provider. As an example of their innovative spirit and understanding of the market demand, they are the first to offer Virgin’s Velocity air mile points on payments in New Zealand.

humm is used by 2.7 million consumers and their digital credit finance offering is the market leader for purchases over $500. The company operates in Australia, New Zealand, Canada, Ireland and have launched in the UK, targeting high price point categories such as healthcare, home improvement, lifestyle and automotive.

How is humm different?

If we were to define what makes humm stand out from other consumer lending and finance brands, it would be about their maturity:

- The core company was founded more than three decades ago, allowing them to pick up trends, insights and build on their experience of operating within consumer finance – whereas many other players have only popped up in the last five years.

- The core customer base is 35-55 years old (older than the traditional users of BNPL), a demographic group that typically earns more and spends less frequently, but on bigger ticket items when they do. Typically, they are of a higher financial maturity with a more careful approach to repayments.

- They offer a great range of products from ‘little things’ (in the BNPL space) to ‘big things’ within the consumer lending space up to £30,000.

- Being FCA regulated, with public listing pedigree, humm is a profitable and sustainable business looking for long-term partnerships with brands that align.

humm UK products

- Up to £3,000

Interest-free, payable over 5 fortnightly or 6 or 12 monthly instalments.

- Up to £30,000

FCA-regulated, with monthly instalments payable up to 6 years. Totally flexible in how the product is set up from interest-free, interest-bearing, and half/half with variable application and monthly fees where applicable.

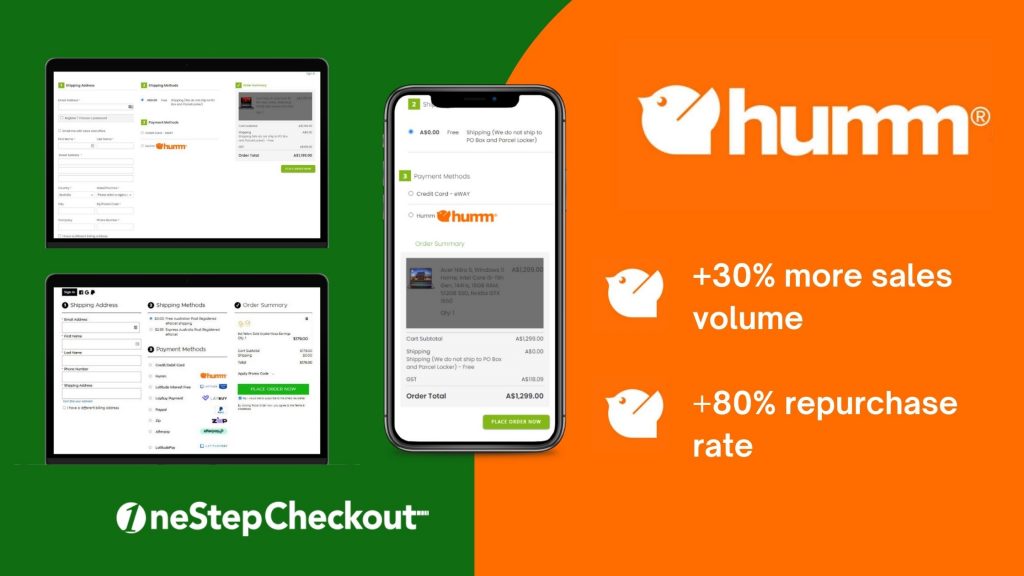

Consumer Electronics: Acer.com.au Magento 2 Checkout Page. using OneStepCheckout and humm

Why use humm with OneStepCheckout?

Benefits of offering Consumer Finance

We are all about checkout conversion and always will be. This alignment has been defined by who we choose to partner with.

Based on our full review, consumer finance and BNPL in the United Kingdom is forecast to account for 10% of e-commerce sales by 2024, reaching £26 billion. With 1 in 5 Brits having used it in 2020, the trend keeps accelerating, pushed by fintech brands and under greater scrutiny from regulators.

humm helps boost key metrics along the eCommerce sales funnel Attracting more customers

- Increasing checkout conversion rates

- Boosting average spend

- Encouraging repeat purchases

In fact, the result they recorded on their Australian customers speak for themselves:

up to 30% more sales volume and up to 80% repurchase rate.

With humm, merchants enjoy further benefits such as:

- Guaranteed settlement the next business day

- Reach consumers who spend on more important purchases such as home improvement, dental care, and travel

- Applications have automated decisions within 10 seconds – with no waiting around, your customers remain firmly in your ecosystem

Examples of Magento merchants integrating humm with OneStepCheckout

Here are a few merchants who already benefit from both humm and OneStepCheckout’s checkout improvements to minimise cart abandonment and achieve more sales from transactions and higher basket sizes.

You will find that humm’s sweet spot is leaning towards retailers of high price points items such as consumer electronics or jewellery.

Shiels.com.au | Jewellery

JW.com.au | Consumer Electronics

One Page Checkout customization over two columns

humm x OneStepCheckout Integration

Magento 2

humm is coded following Magento 2 API guidelines so integrates seamlessly both with the Magento 2 default checkout and OneStepCheckout.

Installation Guide: https://docs.shophumm.co.uk/docs/magento-2-installation-guide

Magento 1

Both humm and OneStepCheckout still support Magento 1. You can see it working live on haarveynorman.com.au

Installation Guide: https://docs.shophumm.co.uk/docs/magento-1-installation-guide

Ready to integrate humm to your Magento store?

Simply email us your store’s URL and phone number and humm will get in touch to help.

Press coverage: